Summary of Martaa Hotel Business Plan

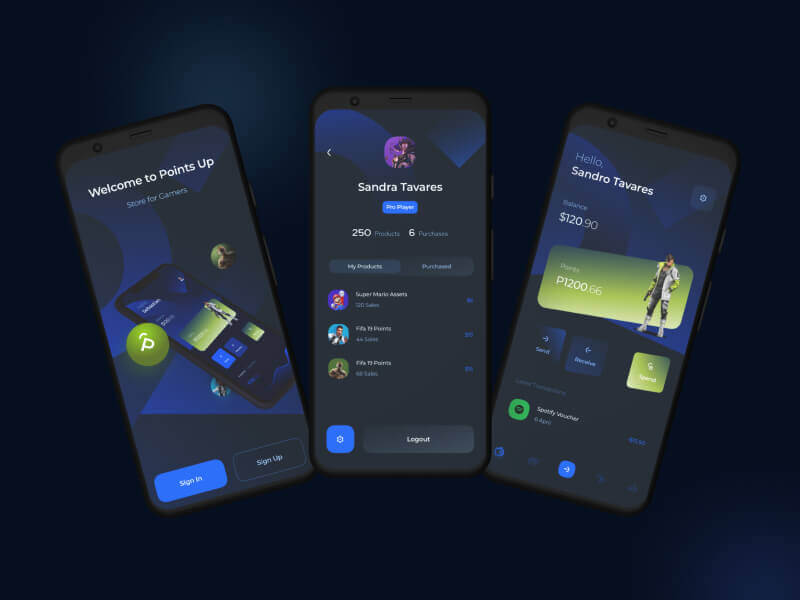

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

The Martaa Hotel business plan is a comprehensive work that outlines the strategic vision and operational roadmap for establishing a modern, community-focused, and sustainable hotel in Diriyah, Saudi Arabia. The plan begins with an Executive Summary that defines the hotel’s vision—to blend modern hospitality with Saudi cultural heritage—and its mission to provide authentic, sustainable, and inclusive guest experiences. Key objectives include market leadership in urban social hotels, guest satisfaction, revenue growth, and a commitment to eco-friendly and socially responsible practices1.

The General Description details the hotel’s strategic location in Diriyah, the significance of its name and logo, and its unique architectural and interior design, which draws inspiration from all regions of Saudi Arabia. The hotel features 108 rooms, multifunctional spaces, and amenities such as a café, restaurant, gardens, and art studios, all designed to foster community and cultural immersion1.

A Company Analysis highlights Martaa’s unique selling propositions, including its focus on cultural immersion, sustainability, flexible spaces, and technology integration. This section also covers industry trends and growth potential within Saudi Arabia’s rapidly expanding tourism sector, driven by Vision 20301.

The Customer Analysis identifies target segments such as millennials, Gen Z, wellness tourists, digital nomads, and business travelers, and addresses market gaps like the need for social spaces, eco-friendly options, and tech-enabled services. Market segmentation is detailed by demographic, psychographic, behavioral, and geographic factors, ensuring broad appeal1.

Competitive Analysis evaluates Martaa’s positioning against major competitors (Fairmont, Ritz-Carlton, Mövenpick, Four Seasons) using SWOT analysis, benchmarking, and pricing comparisons. Martaa differentiates itself through its cultural, sustainable, and community-centric offerings, as well as competitive pricing and value-added packages1.

The Strategic Plan covers revenue management, dynamic pricing, marketing, and distribution strategies, emphasizing direct bookings, digital marketing, and partnerships with OTAs and influencers. Special offers and flexible payment options are designed to attract diverse guest segments1.

The Operations Plan outlines organizational structure, HR needs, legal requirements, and operational policies. It details staffing, outsourced services, and quality management systems to ensure efficient and high-quality service delivery1.

The Financial Plan provides investment budgets, income and expense forecasts, funding sources, profitability analysis, and key financial ratios, demonstrating the project’s viability and sustainability1.

Finally, Key Milestones are established for permits, staffing, quality certifications, and operational targets, ensuring clear timelines and measurable progress. Altogether, the Martaa Hotel business plan serves as a strategic guide for launching and managing a distinctive, sustainable, and culturally rich hospitality venture in Saudi Arabia.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

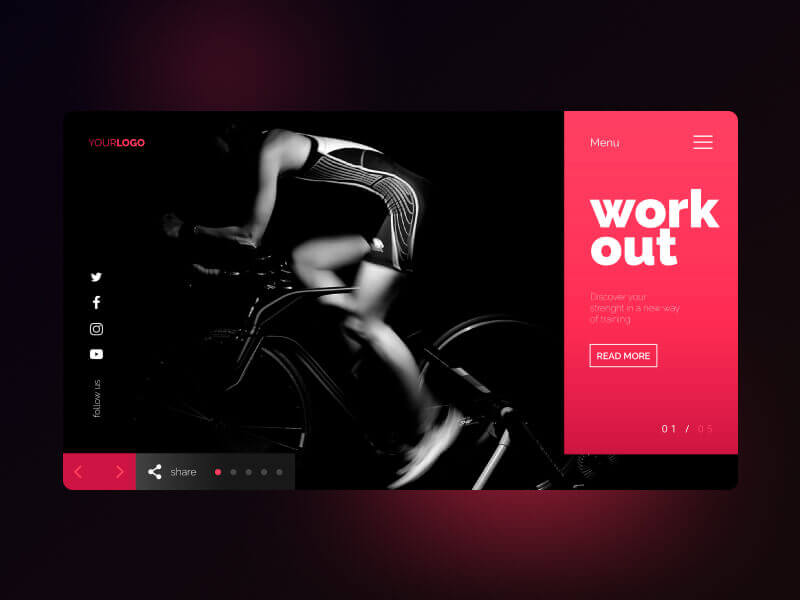

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications.

How can a company be incorporated?

In RAKICC a company can be incorporated only through registered agents. Upon submission of documents an IBC is incorporated within 2 working days.

What are the types of companies can be incorporated?

RAK ICC adheres to Federal Laws of United Arab Emirates and local laws of the emirate of Ras Al Khaimah. RAK ICC in the exercise of its powers, does not allow any illegal activities, including but not limited to gambling activities.

What are the documents need for re- registration?

Can re-registration of an existing company be applied only at the time of its annual renewal?

The company applying for re-registration must be active, hence the Regulations stipulates a company to be re-registered at the time of its annual renewal. In short, if the company is active it can apply for re-registration.

What is the duration within which company renewal can be applied for and when will the penalty be charged?

Renewal applications shall be submitted 30 days prior from the date of expiry, where 30 days from the date of expiry is the grace period for processing without penalty. If the renewal is applied in 180 days from the date of expiry, a penalty will be charged for each month after the grace period.

What is the procedure to be followed for registered agent status renewal?

The renewal invoice would be sent a month in advance of the renewal date. A fee of AED 12,500 is to be paid along with the following documents:

Can a name of the company be approved without the inclusion of any suffix?

A name shall be approved as stipulated in the Regulations where the suffix of the name will be determined based on the type of company being incorporated.

What are the incorporation fees?

It is 2,500 aed

What is the incorporation renewal fees?

It is 3,000 aed

Renewals

What is the duration within which company renewal can be applied for and when will the penalty be charged?

Renewal applications shall be submitted 30 days prior from the date of expiry, where 30 days from the date of expiry is the grace period for processing without penalty. If the renewal is applied in 180 days from the date of expiry, a penalty will be charged for each month after the grace period.

What is the procedure to be followed for registered agent status renewal?

The renewal invoice would be sent a month in advance of the renewal date. A fee of AED 12,500 is to be paid along with the following documents:

Shares

Is a RAKICC company permitted to hold bearer shares?

Bearer share structure is not permitted under RAKICC.

Can shares be held as treasury shares in a company?

A company is permitted to hold treasury shares. All rights and obligations attached to a treasury share will be suspended and shall not be exercised by or against the company while the company holds the shares as treasury shares.

Can a company issue bonus share?

The RAKICC Business Companies Regulations 2016 permits a company to issue bonus shares, partly paid shares, or nil paid shares.

Can a company issue share only with a par value?

A company may issue shares with and without par values. Issuance of fractional shares is also permitted.

What is the currency accepted for share capital?

A share with a par value may be issued in any currency

Why do you need Business Consultant in U.A.E.

To start your own business and register company in Dubai, visit https://bact.ae/free-consultation/

Our Contacts:

Phone+97144470880

Fax: +97144470881

Mob: +971557577199

Email: cs@bact.ae

Web: bact.ae